We are back in 1999. Bill Clinton is acquitted on both articles of impeachment by a two-thirds majority, a procedure that had been initiated due to his affair with Monica Lewinsky. Oskar Lafontaine resigns from his offices because he does not want to support the social policies of the German Chancellor Gerhard Schröder. And at Emporium Hamburg’s headquarters, Achim Becker and Frank von Harten are excited to unpack the first “Elephants”. No, we are not talking about stuffed animals or sculptures – we are talking about a new German silver bullion coin.

| 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 |

| 8.46% | 7.85% | 6.51% | 6.86% | 6.85% | 6.21% | 5.64% | 4.57% | 4.49% | 5.26% |

Average interest rates for 10-year state bonds in the 1990s.

The Economic Background

The management of Emporium Hamburg had been discussing the project of a German bullion coin for a long time. The idea came up due to the economic situation. After a period of high interest rates, during which many citizens invested in German government bonds with interest rates of up to 8%, investing in gold and silver became more attractive again: starting in 1995, interest rates decreased continuously. At first, the decline was quite minimal, then interest rates plummeted drastically between 1995 and 1998. However, the economic situation alone would probably not have been enough to trigger a systematic change in German investment behaviours.

In the 90s, silver and gold were still treated like a neglected stepchild by yield-oriented investors. The silver price per ounce had settled at between $5 and $8, after its abrupt rise in the 1970s and the even more spectacular fall in the 1980s. The gold price was fluctuating between $250 and $400. However, things were about to change. On 2 May 1998, the governments of EU member states decided to introduce the Euro.

At Emporium Hamburg, people thought about what a new currency could mean for the investment behaviours of German citizens. Achim Becker says: “The currency reform of 1948 was associated with losses for many people. At the same time, however, it gave them a new perspective as their money was more likely to maintain its value in the future. In the following 50 years, the DM was revalued three times. A clear sign of successful recovery and a clear sign that the DM was not to lose its value in the long term. Along with the Swiss Franc, the DM was considered the hardest currency of the world thanks to the Bundesbank’s reliable monetary policy. That meant security for all of us. This key element, the DM, was now to be taken away from the Germans and replaced with the Euro. A currency that still had to be put to test. Of course, many citizens feared for their money. And what do people do when they are not only concerned about the value of their money but actually fear depreciation because the currency that gave them security for over 50 years will be taken away? They buy precious metals. It wasn’t a real problem to do so in 2001, even then there was a wide range of investment coins in silver and gold. Many customers told us about their worries and fears. But they weren’t completely sure about simply buying bullion coins in gold and silver in order to change their asset allocation. Somehow, there was no “icing on the cake”. Something was missing. And that’s how we came up with our idea. We offered our customers a simple, safe and affordable way to invest in precious metals and, in addition, to combine this with a product that was of value to collectors. That’s how the Elephant, which is highly popular and sought-after today, came into being.”

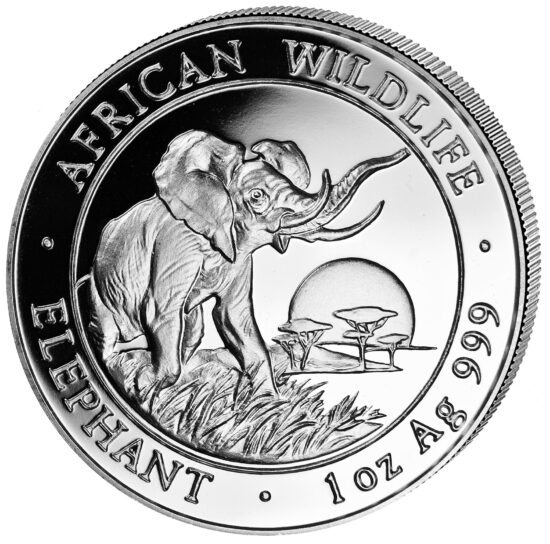

The Motif: A Trip to South Africa

Achim Becker and Frank von Harten found their motif in South Africa. South Africa came in the focus of international tourism in 1995. It became an exciting travel destination, and Achim Becker and Frank von Harten visited it during business negotiations with the South African Mint. Achim Becker recounts: “Of course, we also went on a safari tour. Ever since I was a little boy I had been dreaming about taking a picture of the Big Five. And the things we saw were better than my wildest dreams. We were still very tired when the ranger picked us up from the lodge before sunrise. The night was cold, we sat in the jeep, wrapped in a blanket and listened to the unfamiliar sounds of the wilderness. Although it seemed to be too dark to see anything, we stared into the darkness of the night. The ranger had said that lions and a herd of elephants had been sighted the night before. He constantly talked to his colleagues through the radio to be able to show us the animals. We were just passing over a hill when the sun rose, and in that very moment, a small herd passed by. My mouth was wide open in awe. The majesty of these powerful and yet peaceful animals! I turned to von Harten and said: ‘What do you think about featuring an elephant on our bullion coin.’”

Collaborating with Zambia

While silver bars and medals were subject to a high VAT rate in Germany, a reduced VAT rate of 7% was applied to silver coins before 2014. That was a significant difference for a bullion coin. Therefore, Emporium Hamburg decided to collaborate with an African country to create this silver coin.

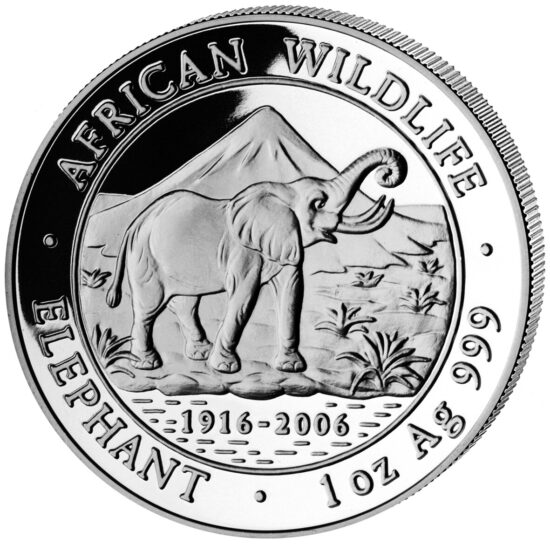

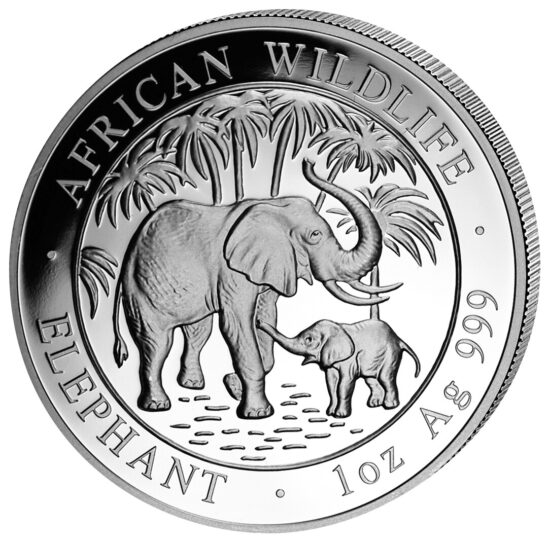

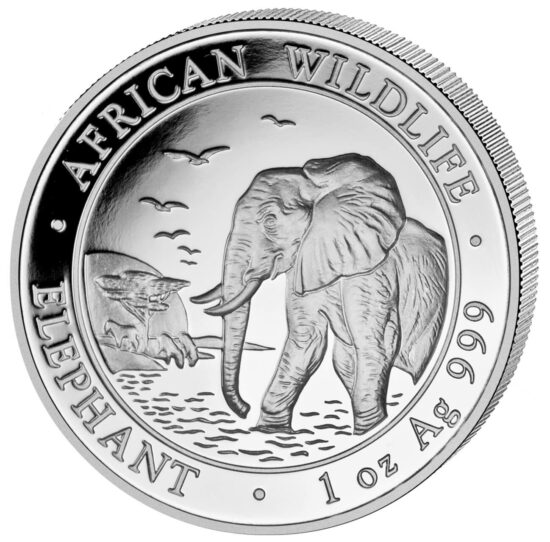

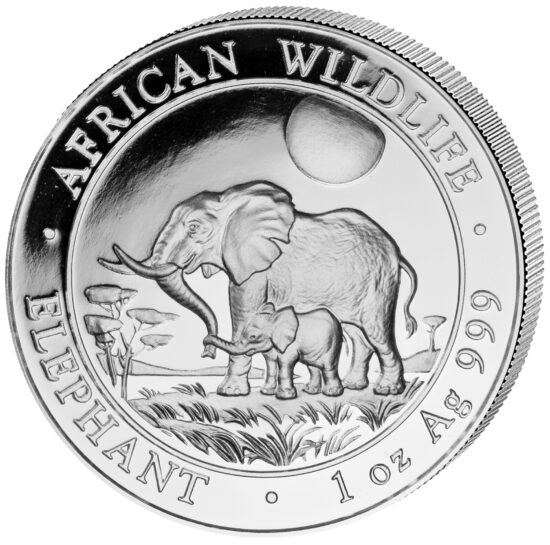

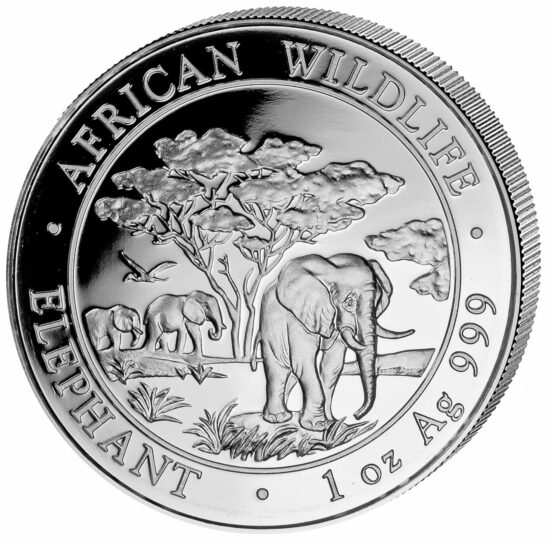

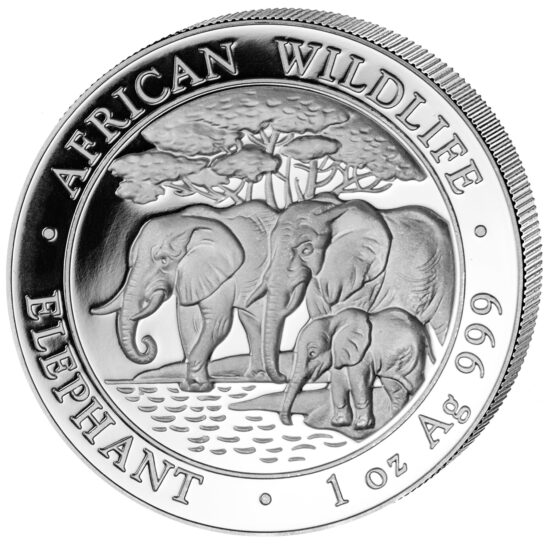

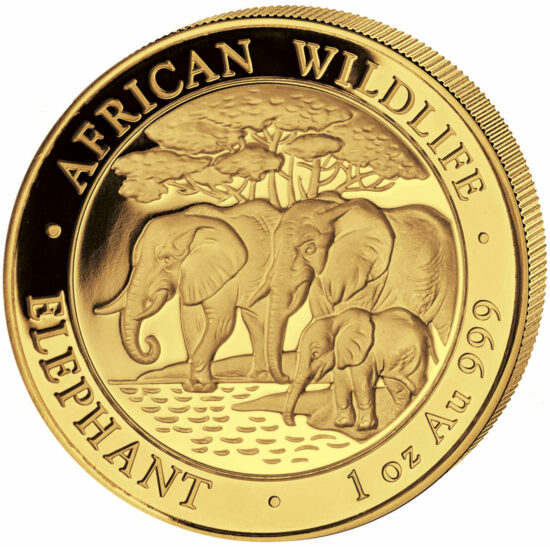

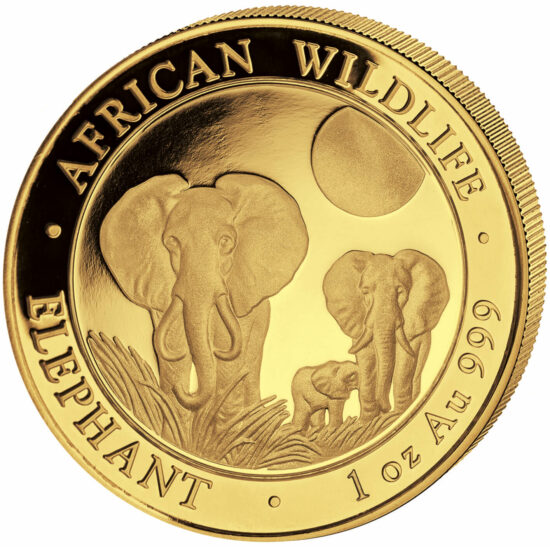

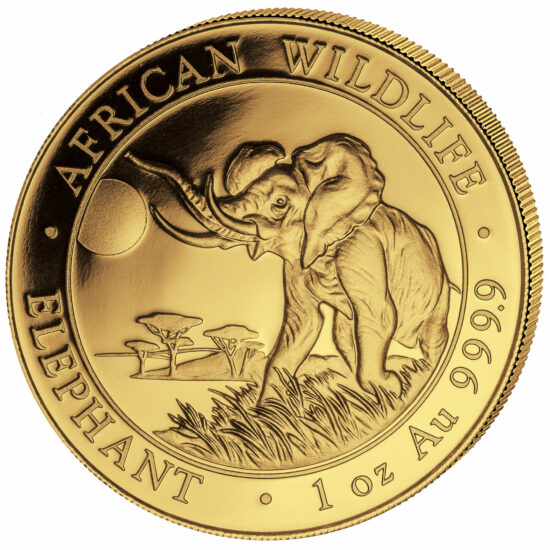

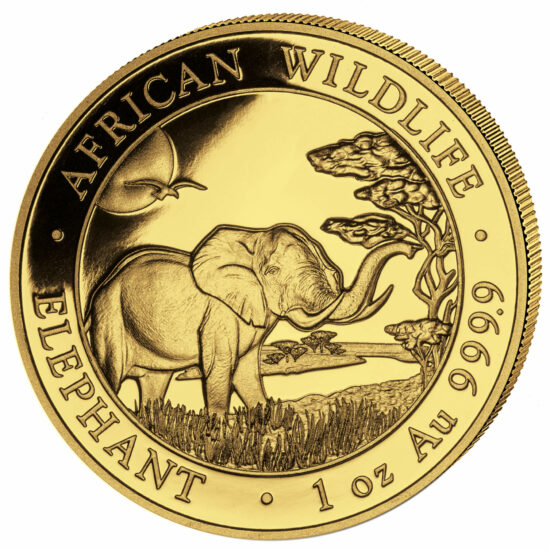

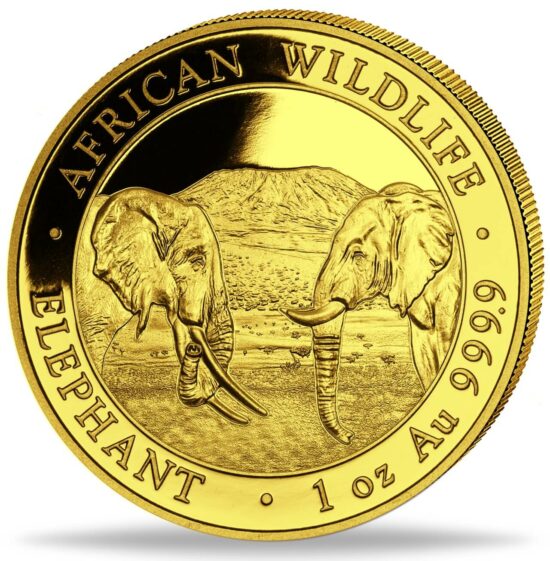

In such a collaboration, the partner country receives a set fee for every issue – and Zambia could well made use of that in the 90s. That is why the first Elephants depict the coat of arms of Zambia, the denomination and the year on the reverse. For the obverse design, they decided to feature an elephant with alternating motifs. To this day, the inscription reads AFRICAN WILDLIFE ELEPHANT and indicates the coin’s weight and fineness.

A Bullion Coin and a Collector’s Item

At the time, the idea of combining bullion coins and collector coins was something new. Classic bullion coins always featured the same motif, only the year changed. And due to the fact that the Elephant depicts a new motif every year, it appealed to collectors and investors alike. A proof version was issued and very well received by the customers. This development enabled investors to choose between buying an investment product and a collector coin. If you look at the numismatic scene today, you will notice that this example has set a precedent. There are hardly any bullion coins left that do not also exist in a proof version with additional mint marks or special variations of the motif. In this context, the Elephant was one of the pioneers of today’s trend.

In fact, there are many collectors today who want to have the entire series of Elephant coins and try to purchase the pieces they do not have on the secondary market. That is not easy because the mintage numbers of the first years were rather low, which is why the prices of these early 1-ounce silver coins can well be in the three-digit range. The same is true for gold coins. Nevertheless, the demand is insatiable.

A New Issuer: Somalia

In 2004, Emporium Hamburg changed partners. Since then, the Elephant has been issued in cooperation with Somalia. The Bavarian State Mint is responsible for the production of the coins. Achim Becker comments: “We found a competent and qualified partner in the Bavarian State Mint, who makes sure that the quality of or bullion coins stays the same. We are very happy with this collaboration. They provide us with the capacities we need to meet the international demand for our bullion coin. After all, the Elephant is one of the world’s most popular bullion coins.”

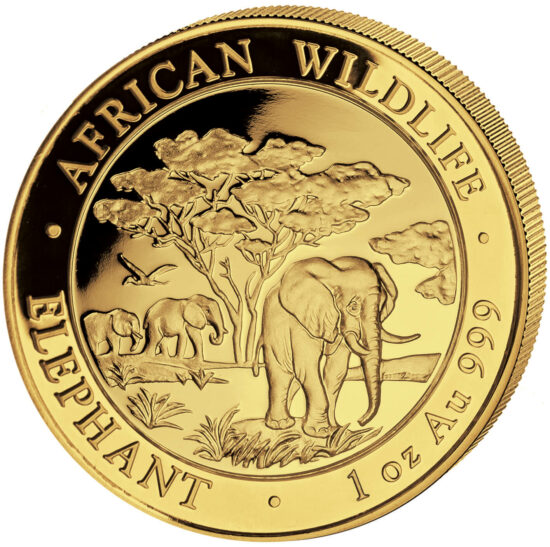

Born in the Financial Crisis: The Gold Elephant

When Lehman Brothers collapsed on 15 September 2008, this also had an impact on the gold price. It rose drastically. Not because speculators expected a profitable business but because people all over the world became afraid that their hard-earned money on their bank accounts would soon be worth nothing. An in such situations, people always turn to precious metals.

Achim Becker comments: “Once we had a problem because the well-established suppliers of bullion coins were barely able to produce enough to satisfy the demand. So we asked ourselves: Why don’t we add a gold bullion coin to our portfolio? That’s why the gold version of the Somalia Elephant was created in 2010.”

The Elephant Today

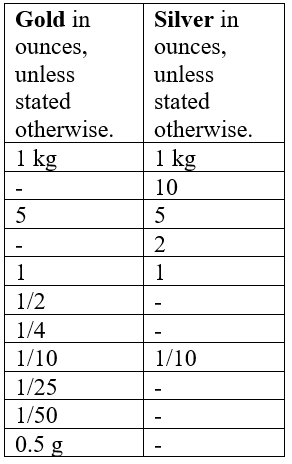

The Elephant has become an integral part of the world of bullion coins. One of the reasons for this is that the coin is attractive, always in stock and available in numerous denominations.

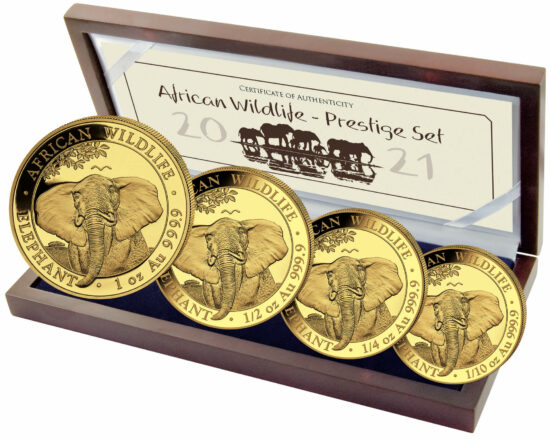

Emporium Hamburg also issues limited premium editions. Among them are the Prestige gold and silver sets, each with a mintage of only 300 resp. 2,000 sets. In addition, there are only 50 pieces of the 5 ounce gold issue, and just 12 specimens of the giant Elephant weighing one kilogram of gold. Of course, these items are not investment products but collector coins that are often already sold out before they are issued.

“What is most important for a bullion coin”, says Achim Becker, “is its acceptance and popularity. We are proud to say that our Elephant is not only sold by us but can also be purchased on many platforms around the globe that are specialised in the bullion trade. When I had the idea for a bullion coin with an elephant, I would have never imagined that.”