Many consider gold to be a crisis-proof investment, which is why it has been extremely popular not just since Covid. Nevertheless, you can still make numerous errors when buying gold if you don’t know any better. Therefore we present you the ten commandments of reasonable gold investment.

1st Commandment: Don’t Think That You Can Purchase Gold for Less Than Its Value!

There are offers that are too good to be true. And yet, time and again you’ll encounter people who fall for it. So if some old mother / a sad stranger / a desperate beauty tells you that she needs to have cash immediately and doesn’t know where to sell her gold coins quickly, be wary. By now, there are perfectly-looking counterfeits and a layman can’t tell the difference between them and an authentic gold coin. Therefore…

2nd Commandment: Buy from a Reliable Source!

You have to decide for yourself whether a source is reliable or not. Of course, there are helpful indicators such as ratings from neutral trade magazines or the membership in an association. The very fact of how long a particular company has been in business tells you a lot about its solidity. Of course, solid offers also exist online, but it can be worthwhile to check whether the things that are told on the website can be verified in real life. And anyway, never buy from or sell something to a place if there isn’t an address you can turn to in case of a complaint.

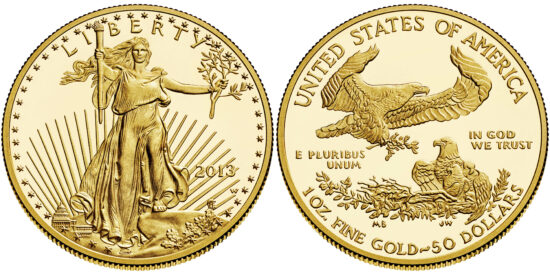

3rd Commandment: If You Want to Buy a Bullion Coin, Buy a Bullion Coin! If You Want to Buy a Collector Coin, Buy a Collector Coin!

There is a fundamental difference between a bullion coin and a collector coin. While bullion coins are mass produced items that will be minted as long as there is a demand, only a previously determined number of collector coins will be manufactured by means of sophisticated, state-of-the-art technology.

Collector coins are collectibles, not investment products. Of course, collectibles can also increase in value, but those who aren’t familiar with the coin market can experience bitter disappointments. Due to the complex techniques used to mint them, these pieces are sold for much(!) more than their material value. This means that you can lose a lot of money if you don’t find a collector who wants to buy the piece from you. (And the collector market for modern coins is very small.) Thus, you should only buy a collector coin if you want to collect, not if you hope that it will increase in value. If you want to invest your money in gold, buy a bullion coin.

4th Commandment: Don’t Trust Anyone Who Wants You to Believe That the Grade of a Bullion Coin Is of Any Importance!

In recent years, there has been a trend to mix the categories of bullion coins and collector coins beyond recognition. Thus, some mints sell Proof bullion coins – at a much higher price.

And some coin dealers in the USA send large quantities of bullion coins to grading institutes. Such grading institutes will assess how perfect the minting quality of a coin is – nothing more, nothing less. Since bullion coins are mass-produced items and do not meet the high standards in terms of minting technology that collector coins do, there are significant differences. And the consigning dealers take advantage of this phenomenon: they sell bullion coins of average quality at the normal price and bullion coins of extraordinary quality for much more. They justify this difference in price by saying: only few pieces are of such wonderful quality, therefore they are collectibles.

That’s nonsense. A bullion coin is a bullion coin, and the mintage numbers are so high that even the most perfect quality isn’t of any importance. Keep your hands off it! And remember commandment No. 3: If you want a bullion coin …

5th Commandment: Calculate the Gold Price of the Coin!

The easiest method not to fall for such dubious offers is to calculate the actual gold price of the gold coin per ounce. Regarding typical bullion coins made of 1 ounce of gold, the additional amount that has to be paid for the minting process is only a few percent. Of course, if you don’t buy a 1 ounce coin but 10 coins weighing 1/10 ounce, the gold price will increase due to the minting cost.

A rule of thumb goes: the lower the denomination, the higher the gold price.

And we’ve already learned that the sum added to collector coins due to the minting process is way higher.

6th Commandment: Determine How Much Money You Want to Invest in Gold Coins!

Nowadays, the diversification of assets is more important than ever. Any one-sided investment policy is an incalculable risk. Our heads have long understood that inflation (+ management fees) make our savings accounts lose value, nevertheless, many people love their savings account, perhaps because it is so little work and the amount of money in it is constantly increasing. At least it looks like that. However, the amount of things you can buy with this ever-increasing sum is constantly shrinking.

That’s why we should invest more money in tangible assets. These include stock, real estate and, of course, gold. Regarding these assets, one simple principle applies: supply and demand determine the price. This is an advantage in terms of inflation because if there’s more money on the market, the price paid for tangible assets will increase. In terms of security, on the other hand, it is a disadvantage: when demand falls, the price falls too.

Therefore, it makes no sense to invest all your money in gold. But it makes sense to invest part of it in gold – but please not so much that it hurts if the gold price drops significantly; it should be so much that it enables you to make a fresh start in case inflation causes your savings to evaporate.

Every investor must decide for themselves how much this sum actually amounts to.

7th Commandment: Whether Buying or Selling, Never Wait for the Perfect Moment!

Talk to successful investors around the world: they will all tell you that they didn’t make money by waiting for the perfect moment but by constantly looking for trends. If you wait to sell gold at the highest price, you will certainly miss the most favourable moment. Therefore, you should rather focus on long-term trends and get in and out in good time.

8th Commandment: Store Your Gold Coins in a Safe Place!

Owning gold coins makes you vulnerable – to thieves, fraudsters and, in the event of a fundamental change of politics, also to the state. That’s why you should think carefully about where to store your gold coins. The safest place, of course, is a deposit box at a bank. However, bank deposit boxes are particularly vulnerable to governmental action. When the USA introduced the gold ban in 1933, the first step was to require all banks to open their customer’s safe deposit boxes in the presence of a state official, who then bought the gold at a set gold rate.

If you want to avoid the risk of keeping gold coins at home, you can consider switching to one of the private companies that offer safe deposit boxes.

9th Commandment: Consider Other Options, But Don’t Buy Anything You Don’t Understand!

By now, there are many forms of investment that are based on gold without being connected to the real object. They all have advantages and disadvantages, and you should inform yourself about them in detail. We will briefly mention the most important alternatives regarding which the customer does not invest in physical gold but still benefits from the increase in gold price:

- In case of gold saving plans, the investor acquires a monthly amount of gold which his supplier stores for him

- By means of gold certificates, the buyer bets on the performance of the gold price; gold certificates are bonds and the issuer is the debtor

- Exchange Traded Commodities (ETC) are similar to gold certificates, but have no time limit and can be traded on the stock exchange

- Listed stocks of gold mines or refineries / equity funds with a focus on gold

If you are interested in one of these alternatives, find out exactly what their advantages and disadvantages are – and don’t buy anything if you can’t assess hidden costs and risks because you don’t understand the investment product.

10th Commandment: Never Forget Your Common Sense!

The last and most important commandment of purchasing gold is the 10th – and it is sad to see that many don’t adhere to it for the sake of greed: always be wary and use your common sense. If you do not get carried away by a favourable opportunity, but reasonably evaluate profit, loss and risk, you cannot go wrong when buying gold!